What is Natural Gas Storage?

Natural gas storage refers to the practice of injecting surplus natural gas in underground facilities from Mar-Nov to ensure sufficient supply through the withdrawal period in the winter.

The three main types of storage are depleted oil and gas reservoirs, aquifers, and salt caverns. These storage facilities help support a steady supply of natural gas, during extreme weather conditions and demand surges.

The Relationship Between Storage Inventories and Energy Prices

Beyond heating homes and businesses, Natural gas plays a crucial role in electrical generation across the United States, comprising of nearly 45% of the total generation in 2023. As such, the Natural Gas storage inventories are a key market driver in both the gas and energy landscape.

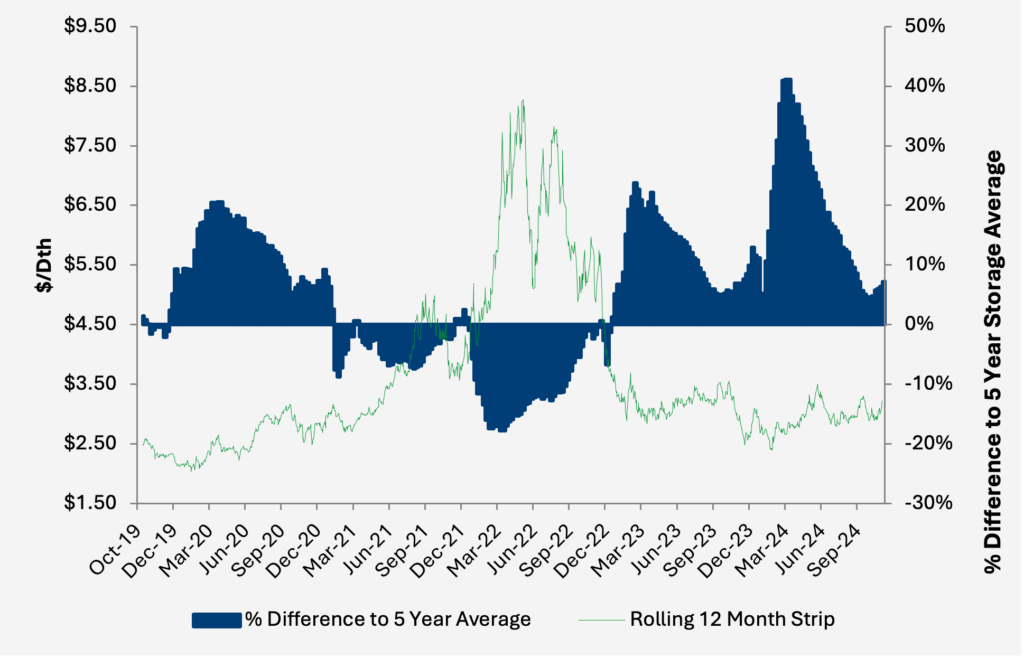

When storage inventories are relatively high against the five year average, the ample supply often keeps near term gas future prices stable or low. On the other hand, when storage levels are low, the market tends to see greater volatility and price premiums. The below graphic shows the direct relationship between the storage levels compared to the 5-year average and a rolling 12-month NYMEX strip.

How Low Storage Inventories Affect Prices

When natural gas storage inventories are low, prices can rise sharply as lower storage levels signal that there might not be enough supply to meet peak demand, especially if a particularly cold winter is expected. When this happens, energy companies and consumers compete to secure available natural gas, driving prices up.

How High Storage Inventories Affect Prices

When natural gas storage inventories are high, prices tend to decrease or remain stable. Excess gas in storage may indicate that the market is well-supplied, reducing the need for price hikes.

However, even high storage levels can cause market shifts. If storage capacity begins to reach its limits, companies might adjust their withdrawal or injection strategies, or they may opt to export excess gas to international markets. The global nature of the natural gas market, especially with rising exports of Liquefied Natural Gas (LNG), can also influence domestic storage levels and, consequently, domestic prices.

Market Influences on Storage Levels and Prices

Several factors affect storage levels and, by extension, natural gas prices. One of the most significant factors is weather. A harsh winter or an unseasonably hot summer can significantly impact the amount of gas needed for heating or cooling, causing fluctuations in storage levels and, subsequently, prices.

Geopolitical events also play a crucial role. Disruptions in global supply chains, such as pipeline shutdowns or conflicts in major gas-producing countries, can cause shifts in both domestic and international markets. This can lead to increased demand for U.S. natural gas, which may deplete domestic storage faster and push prices up.

Technological advancements have also contributed to the management of natural gas storage. Innovations in both storage technology and data analytics have helped companies better predict consumption trends and optimize storage strategies. These improvements can prevent extreme price fluctuations and allow for more efficient use of storage capacity.

Conclusion

Natural gas storage inventories are a key factor in determining the price of domestic natural gas. By acting as a buffer against seasonal demand fluctuations, storage helps to stabilize prices and prevent extreme volatility. However, when storage inventories are low, prices can rise rapidly, particularly during periods of high demand.

As the global energy landscape continues to evolve, with shifting weather patterns, geopolitical dynamics, and technological advancements, it is crucial for consumers and businesses to stay informed about the factors that influence energy costs. Understanding the connection between storage inventories and natural gas prices can help individuals and companies better navigate the energy market and anticipate potential price changes in the future.

If you’d like to keep up to date with natural gas storage inventories, please click here to subscribe to our weekly Natural Gas Storage report.