The capacity market is a cost component on your electric bill charged by your Independent System Operator (ISO) to guarantee future consumer electrical demands are met. In other words, if everyone in their respective region turned on their lights and air conditioners at the same time, the grid has the capacity to handle the load.

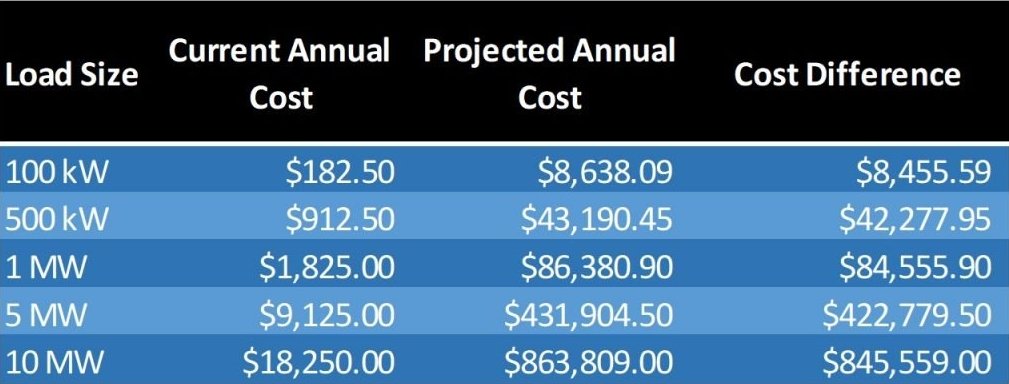

Each major electric territory governed by an Independent System Operator (ISO) calculates the needs and costs a little differently, but the end goal is the same: to ensure the future reliability of the grid. MISO is responsible for power grid reliability and pricing across fifteen states in the central region of the US. On April 14, 2022, the Midcontinent ISO (MISO) published its 2022/2023 Auction Results determining the Capacity price across the different regional zones. In many zones, the capacity price jumped an eye-popping 4,633% from $5.00 MW-day to $236.66 MW-Day. See Fig. 1 for the projected impact on different customer classes.

Fig. 1 – MISO capacity cost increase expectation

How does this affect other ISO zones?

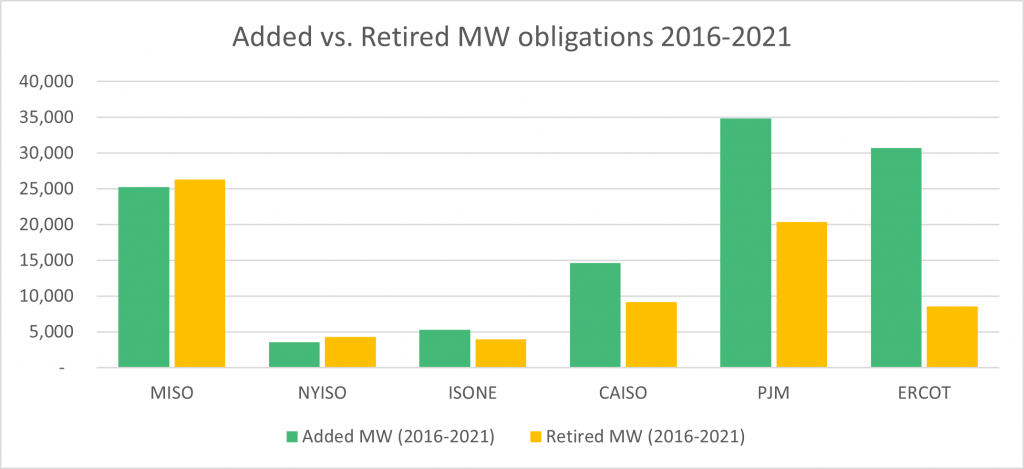

With the country coming out of the pandemic and an uncertain global geopolitical climate, do the other ISO zones run the same risk of spiking by several thousand percent? We don’t think so, because in the last five years MISO has retired 1,064 MW more generation than it has added. By comparison, the other ISO regions (PJM, NYISO, ISO-NE, ERCOT, CAISO) combined have added 42.6 MW more than they have retired. In other words, these regions brought on 92% more power than they retired. As noted in Fig. 2, NYISO is the only region that also retired more than it brought on during this period.

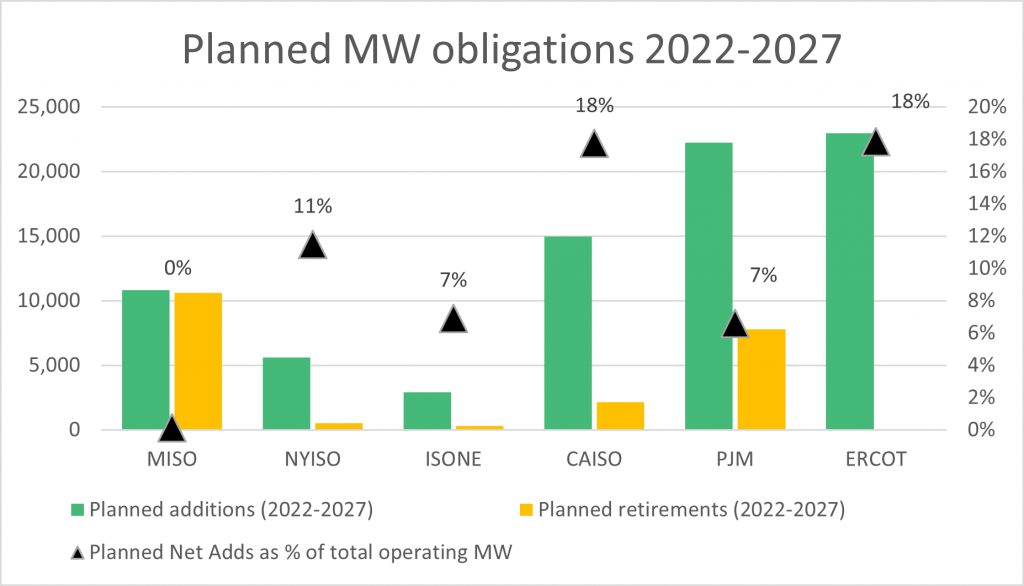

If we look forward five years, we can see the trend in all five major deregulated markets are expected to increase supply onto the grid by nearly 50,000 MW or a 12% increase of total operating MW, whereas MISO looks to be almost flat.

In short, the Midcontinent ISO (MISO) sees a market responding to a region not keeping up with demand as it attempts to shift out of older technologies for cleaner and greener energy options. In contrast, the other major ISOs should be more insulated and prepared for the capacity obligations. We do not expect to see any capacity auction results by other balancing authorities to be nearly as stark even with demand growing out of the pandemic.

If you’re seeking additional insights or advice on energy markets, we invite you to reach out to us. The Atlas Retail Energy team is eager to answer your questions. You can reach out to Eric Sinitski or contact us.