Heading into this winter season with an understanding of the associated risks and opportunities in the energy markets is critical to your near term and future purchasing strategies. Utilizing Atlas can help you navigate and take control.

Heading into this winter season with an understanding of the associated risks and opportunities in the energy markets is critical to your near term and future purchasing strategies. Utilizing Atlas can help you navigate and take control.

Under the scope of Atlas Eyesight, we are proactively monitoring the National Oceanic and Atmospheric Administration’s Climate Prediction Center (NOAA) data and the forecasted La Nina patterns moving onto the radar. Energy market volatility will be heavily determined by weather in the upcoming months.

In La Niña cycles, the opposite effect of El Niño Southern Oscillation, stronger than normal trade winds can cause winter temperatures warmer in the north and colder in the southern hemisphere. This typically suggests droughts in the southern U.S., heavy rains and flooding in the Pacific Northwest and Canada, and a more severe hurricane season. Historically this will be the second La Nina cycle to return since the most recent period lasted from August 2020 to April 2021 according to the NOAA.

Relative to energy this implies several factors including steadied natural gas fuel production, a below average heating demand, a longer injection season, and natural gas storage levels increasing back up from below the five-year average. If warmer than average winter temperatures actualize this could maintain a bearish effect on markets.

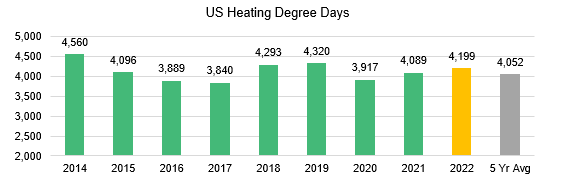

The Energy Information Administration (EIA) data suggests overall heating needs have decreased as well since the highs of the 1950-80’s due to climate warming. Heating degree days (HDD) are the number of degrees that a day’s average temperature is below 65°F. In 2018 and 2019 the number of HDD’s was above 4,200. In 2020 there were less than 4,000 HDD’s. With current weather projections for calendar year 2022 (HDD) are expected to be less than the recent high of 2019, but higher than the previous 2 years.

NOTE: 2022 is projected HDDs from the EIA Short Term Energy Outlook (STEO)

However, if colder weather materializes it may create high volatility and bullish sentiment. Cold winter patterns could expose index markets to price spikes. Considering highly variable winter weather is anticipated, cold outbreaks could have more effect on the Northern states and Southern States may only see short lived periods of cold air. New England, the Midwest and the Great Plains are likely the most vulnerable areas for the impacts of potential cold outbreaks. January appears to be the coldest month on a nationwide gas consumption basis this winter.

With Atlas, our process will allow for a comprehensive review of your historical and current energy profile to identify seasonal risks and opportunities. Together we will determine your organizational goals and execute the most cost-effective customized and calculated market timing purchasing strategies. Helping you manage and reduce on usage and spend while efficiently navigating near term and future sustainable strategies.

Contact us or reach out directly to Sean Sweeney to learn more about how Atlas can help your business today.