As we make our way into the winter of 2020/2021, COVID-19 cases are surging across the majority of the U.S., foreboding a bleak winter ahead. If you are someone who needs to secure your next natural gas or electricity contract on the other hand, things look far less bleak.

As we make our way into the winter of 2020/2021, COVID-19 cases are surging across the majority of the U.S., foreboding a bleak winter ahead. If you are someone who needs to secure your next natural gas or electricity contract on the other hand, things look far less bleak.

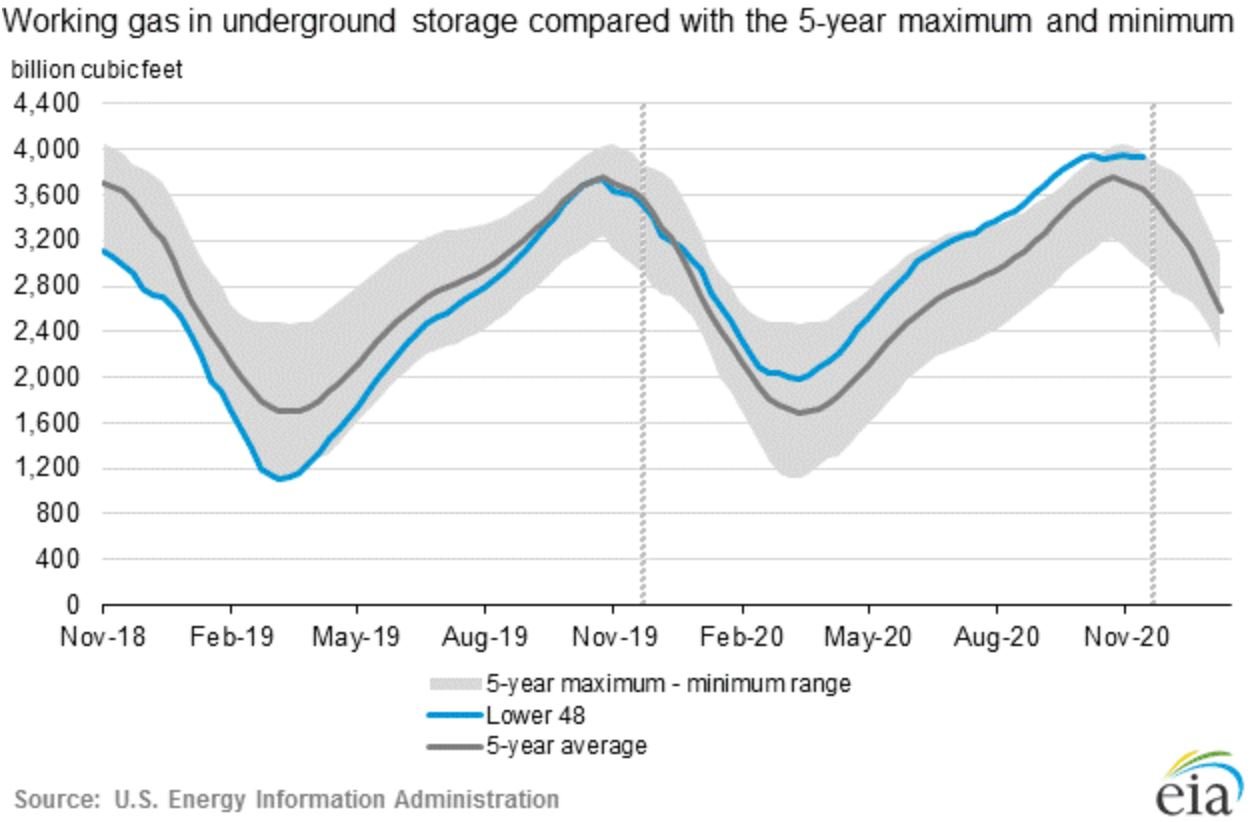

We have just concluded one of the warmest Novembers on record. The weekly EIA Natural Gas Storage Report, released each Thursday, is a closely followed indicator of the supply/demand balance for natural gas domestically. For the 12/3 report, the data was expected to show a withdrawal (or decline) of 13 billion cubic feet (Bcf) of natural gas from underground storage according to analysts polled by S&P Global Platts. Instead, there was only a 1 Bcf withdrawal indicating plentiful supply and weak demand. This sent the market plunging with the prompt month January contract dropping roughly $0.30/MMBtu to $2.48/MMBtu, a historically low price. Much of the decline may have been attributed to speculative traders unwinding their long positions; recent Commodity Futures Trading Commission data showed net longs dropping by more than 20%.

Moderate temperatures are forecasted across much of the country over the next two weeks, with temperatures in the Midwest expected to be 15-20 degrees warmer than average. Aside from a near-term short covering rally, gas and power markets are likely to remain bearish until winter cold arrives in a sustained way. After two historically mild winters in a row, we may be in for yet another. Whether cold materializes or not, consumers of gas and power currently have an opportunity to hedge future contracts at extremely advantageous levels.

For more information, reach out to Pete at peter.lawlor@atlasretailenergy.com.

Learn more about our services or how to become an energy broker today. Just fill out the form below and someone will contact you within 1 business day.