The energy landscape is constantly evolving to adapt to stricter climate regulations and take advantage of global economic opportunities. Since the beginning of 2017, or when Trump took office, domestic coal production has dropped over 30% and coal mining employment fell 24% in that same time. This decline occurred despite the Trump Administrations effort to support the coal industry by pulling out of the Paris Climate Agreement, reducing emissions standards on power plants, and incentivizing coal generation through subsidies.

The energy landscape is constantly evolving to adapt to stricter climate regulations and take advantage of global economic opportunities. Since the beginning of 2017, or when Trump took office, domestic coal production has dropped over 30% and coal mining employment fell 24% in that same time. This decline occurred despite the Trump Administrations effort to support the coal industry by pulling out of the Paris Climate Agreement, reducing emissions standards on power plants, and incentivizing coal generation through subsidies.

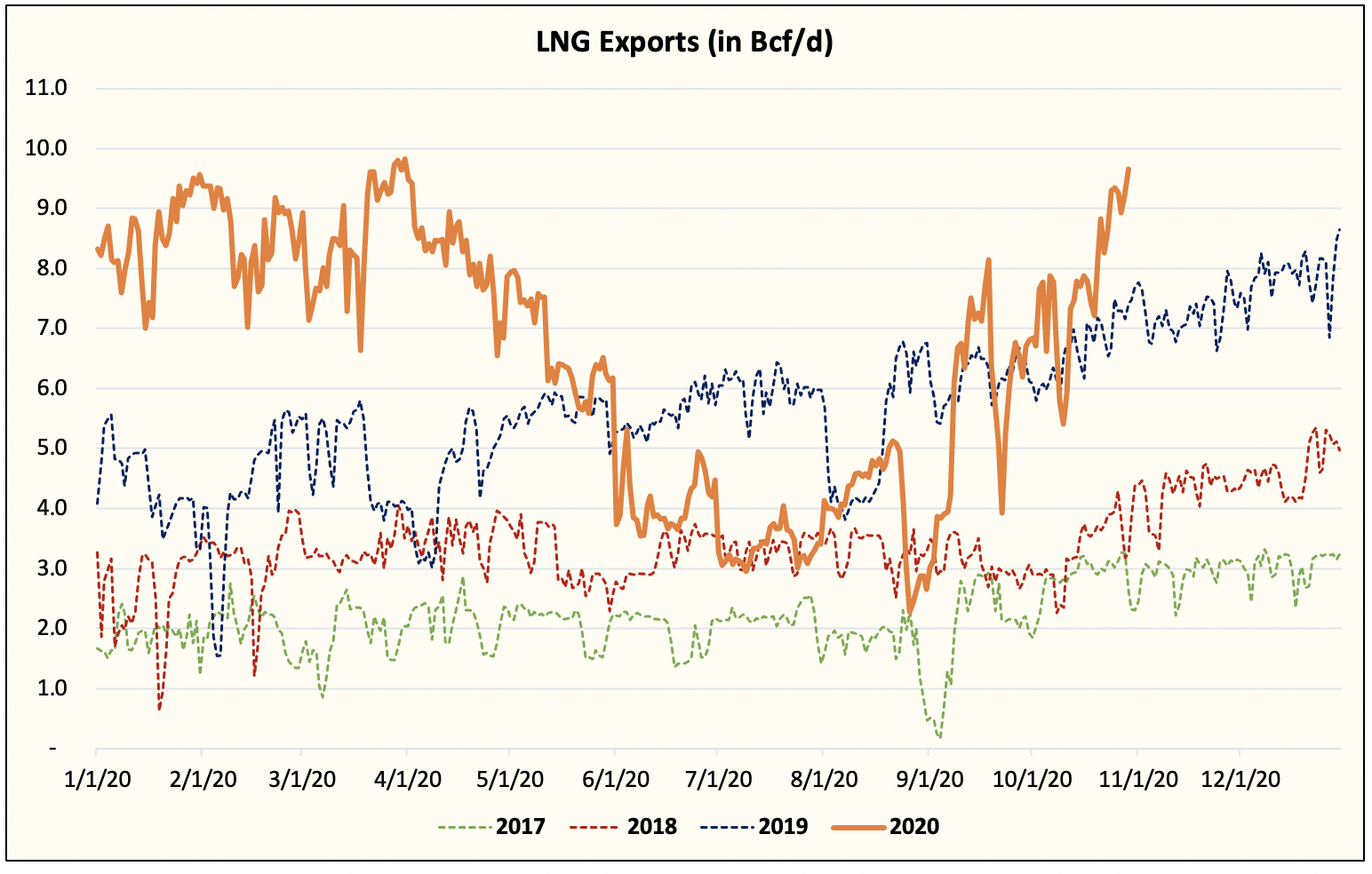

Natural gas production has largely offset the declines seen on the coal side of the ledger. The U.S. is now the top global producer of natural gas and is on track to post its fourth year in a row as a net exporter of the commodity. While the coal sector shrank during Trump’s time in office, Liquefied Natural Gas (LNG) exports have quadrupled.

The United States hit a high LNG export level of 8 Bcf/d back in January 2020. With global energy demand at a standstill this summer because of the COVID-19 pandemic, export levels dropped to 2 Bcf/d, the lowest since December 2016. With global energy demand rebounding this fall, LNG levels crept higher by the day. As of this writing, US exports were hovering around an all-time high of 10 Bcf/d. The persistent rise in demand for exports has put pressure on domestic natural gas pricing. A continued rise in LNG exports will serve as a bullish indicator heading into 2021.

Please reach out to an Atlas Advisor to discuss how changing market dynamics will impact your organizations future energy budget and create a custom plan to strategically manage future risks.